Woodbridge Tax Bills Rise Following Revaluation and Budget Increase

Understanding local spending decisions and real estate value shifts

Over the past few weeks, residents of Woodbridge have taken to social media to vent frustrations, share reactions, and speculate about what caused their property tax bills to spike — in some cases by large percentages. The conversation has been spirited, and at times confusing. Discussion about the mill rate, grand list, and revaluation process has circulated alongside theories about the possible impact of construction projects, budget growth, and political priorities.

One way to understand our recent tax bills is to step back and look at the big picture — where revaluation meets budget growth, and where spending decisions meet the real-life consequences contained in our tax bills.

What Happened This Year?

In 2024, Woodbridge completed a state-mandated revaluation of all properties, required every five years. This process updated all property assessments to reflect current market values and redistributed the tax burden among property owners based on changes in relative value. The result of revaluation was a 44.6% increase in the town’s grand list, driven primarily by rising real estate values.

Now Woodbridge property owners are seeing significant increases in their FY2026 tax bills after this revaluation coupled with the Board of Selectmen and Board of Finance adoption of a budget that raises 4.78% more from property taxes than the previous year.

Town Budget Process

Each year, total Town spending for the coming fiscal year which runs July through June, is set by the BOS and BOF after a series of joint budget meetings followed by the Preliminary Budget Hearing in April, and finally the Annual Town Meeting in May. In 2025, the Joint Budget meetings took place January 21, January 23, January 28, January 30, and February 4.

A Revenue-Neutral Mill Rate

One concept that can frame the budget development process is known as the “revenue-neutral mill rate.” This term is used in municipal finance to describe the mill rate that would raise the same total property tax revenue as the prior year, despite changes to the grand list. In a revaluation year, it reflects a flat-budget scenario where only the distribution of who pays what changes, based on updated market values.

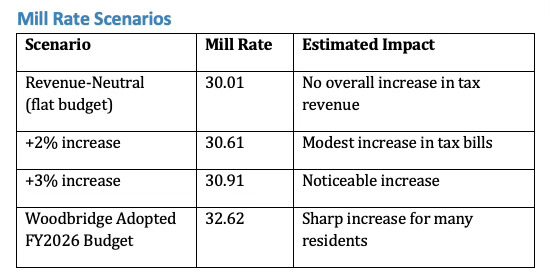

Serving as a kind of fiscal baseline or reference point, the revenue-neutral mill rate can help town leaders and residents more easily understand the tradeoffs involved in spending above that level. In Woodbridge’s case, the estimated revenue-neutral mill rate after the 2024 revaluation was approximately 30.01 mills as noted by the Finance Director at the Feb. 4 Joint Meeting of the BOS and BOF (click the video image below for that portion of the meeting).

A revenue-neutral mill rate of 30.01 mills would generate the same total property tax revenue as the prior year. Ultimately though, by the end of the budget setting process, the adopted FY2026 mill rate was set at 32.62, about 8.7% higher than the revenue-neutral rate.

Setting the FY2026 Budget

Once the Town’s overall spending plan was approved the night of the Annual Town Meeting, the amount to be raised by taxes in FY2026 increased 4.78% over the prior year, rising from $50,854,529 to $53,285,215. Full budget details are available in the FY2026 Adopted Budget document.

No Impact from Certain Projects or Policies

Some residents suggested on social media that the cost of projects like the new Training and Storage Facility behind the firehouse contributed the increase. However, that project was fully funded in prior years through a combination of state grants, federal ARPA funds, a small capital allocation last fiscal year a small capital allocation last fiscal year, and by donations from the Woodbridge Volunteer Fire Association – resulting in no FY2026 impact.

Similarly, the motor vehicle tax rate has been capped at 32.46 mills by state law and for several years the Woodbridge budget has incorporated this maximum rate. This did not change and had no added effect this year.

Calculating Tax Bills

Residents can use an online mill rate calculator to see how various mill rates would have impacted your own tax bill. For example, there’s a good one available on the City of Milford’s website. To help illustrate the tradeoffs between spending levels and tax impact, you can input your property’s assessed value (look up your tax bill on the Town Website) and the following example mill rate scenarios, below.

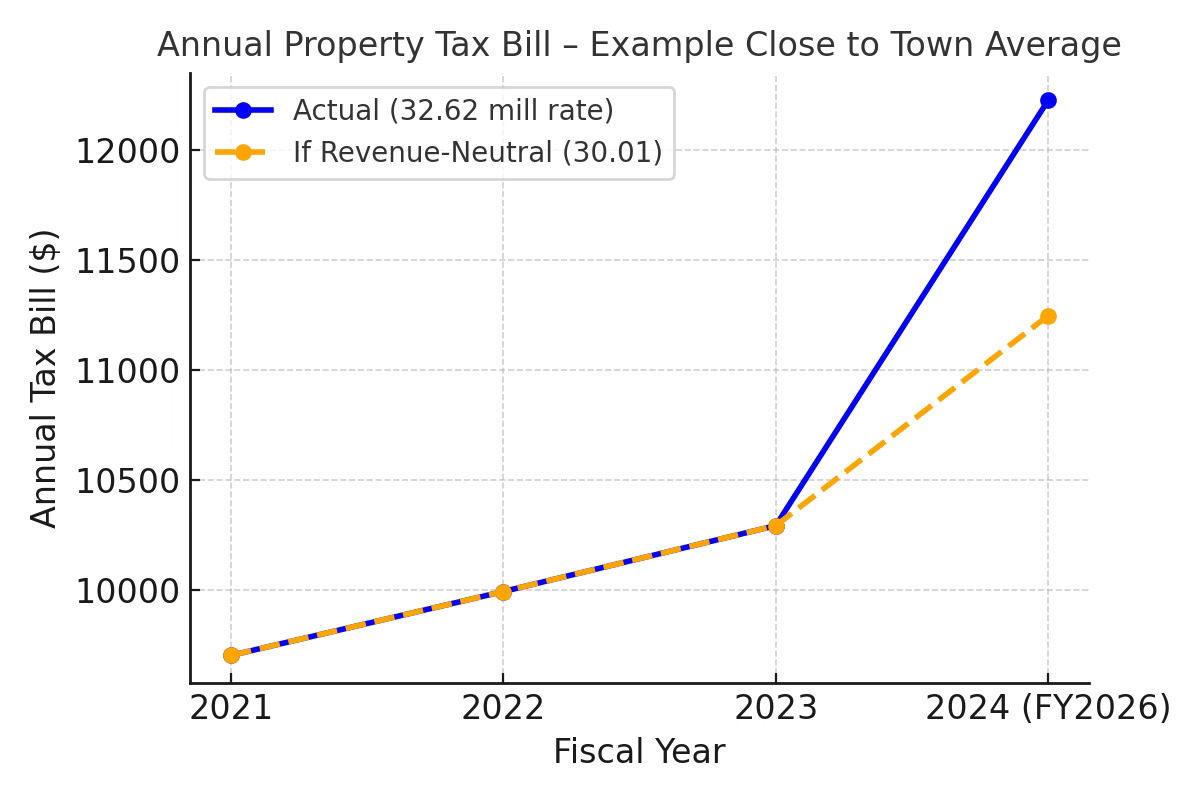

An example tax bill for a property valued close to the town average shows the sharp jump in FY2026 following the revaluation and budget increase that resulted in the current mill rate of 32.62 (blue line) compared with what it would have been under the revenue-neutral mill rate of 30.01 (dotted orange line).

Editor’s note: This article is written by Sheila McCreven in her role as editor of the Chronicle. Sheila is also an elected member of the Board of Selectmen (term ends Dec. 31, 2025). See the Editorial Note on Government Coverage on our About page to learn more.